Introduction

A forex fundamental analysis course teaches traders how to understand the economic forces that drive currency markets. If you want to learn forex fundamental analysis properly, build real forex trading fundamentals, and master currency trading fundamentals, structured education is essential. This guide explains what a forex fundamental course includes, who it’s for, and how advanced traders use forex trading advanced fundamental analysis to build consistent market conviction. Whether you’re a beginner or refining professional skills, this is your complete reference.

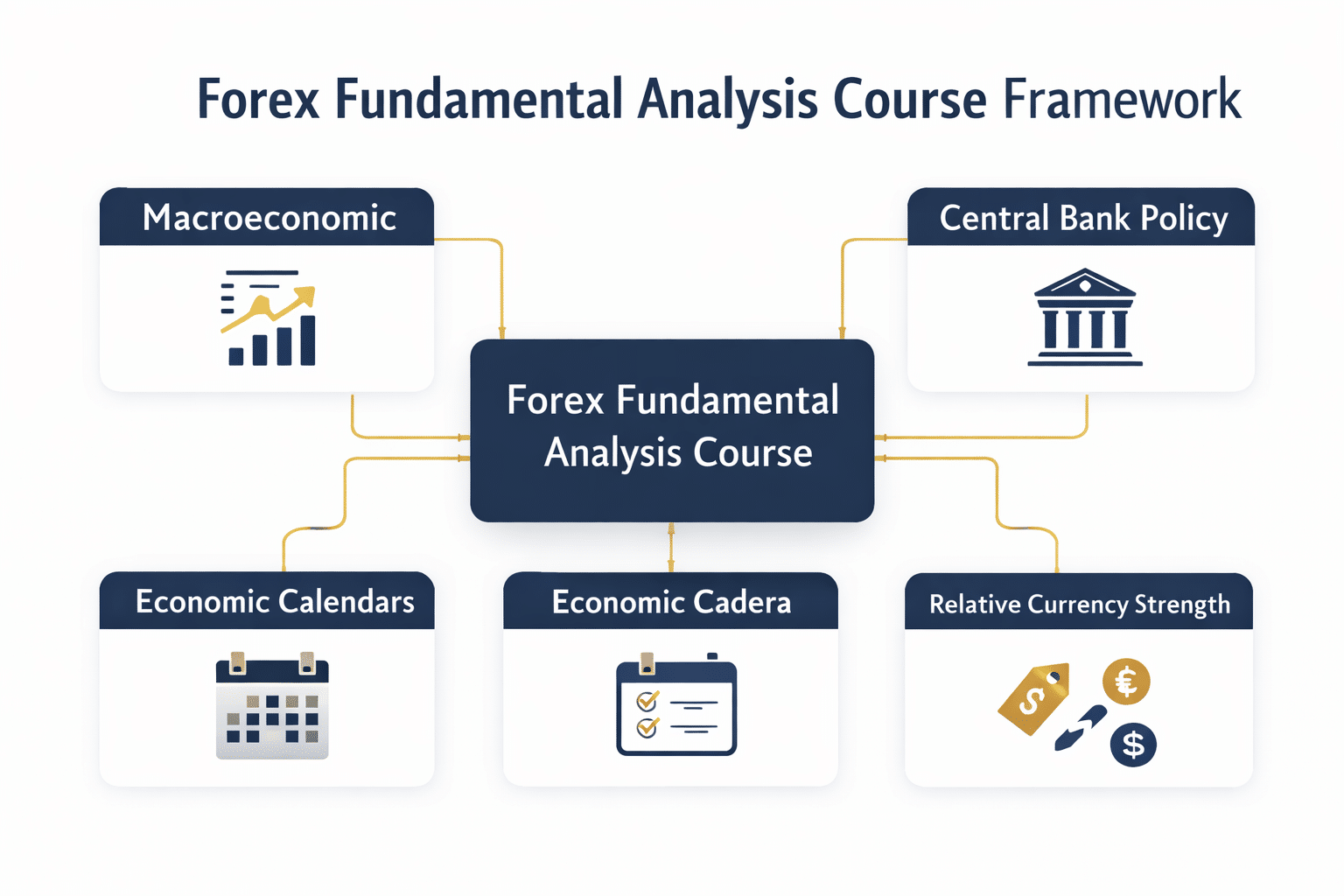

Forex fundamental analysis courses train traders to convert macroeconomic data into structured trading decisions.

Definition:

A forex fundamental analysis course is structured training that teaches how to analyse economic data and central bank policy to determine currency direction.

What Is a Forex Fundamental Analysis Course?

A forex fundamental analysis course is a structured learning programme focused on teaching traders how to interpret macroeconomic data, central bank policy, and financial conditions to forecast currency movement.

Unlike generic trading tutorials, a forex fundamental course develops deep understanding fundamental analysis in forex. Students learn how interest rates, inflation, GDP, employment, and trade balances drive long-term currency valuation. This builds real forex trading fundamentals rather than reliance on indicators alone.

Professional traders use the same frameworks taught in high-quality forex fundamental analysis courses.

Why Learn Forex Fundamental Analysis?

Most retail traders fail because they trade without understanding underlying market forces. When you learn forex fundamental analysis, you stop reacting to price noise and start trading with macroeconomic structure.

Forex trading fundamentals help traders:

- Identify high-probability market direction

- Avoid trading against macroeconomic trends

- Understand news releases with context

- Build confidence in long-term positioning

Currency trading fundamentals provide the foundation used by institutional desks, hedge funds, and professional macro traders.

What You Learn in a Forex Fundamental Course

Macroeconomic Data Analysis

Students learn to read inflation reports, GDP releases, employment data, and trade balances. This forms the core of understanding fundamental analysis in forex.

Central Bank Policy Interpretation

Courses teach how to analyse interest rate decisions, policy statements, and forward guidance from central banks such as the Federal Reserve and European Central Bank.

Economic Calendar Mastery

Traders learn to track scheduled events, measure expectations, and anticipate volatility around major releases.

Relative Currency Strength

A key element of forex trading fundamentals is comparing two economies to determine which currency should strengthen.

Trade Bias Construction

Students combine all macro inputs into structured trade plans. This completes real-world forex fundamental analysis training.

Forex Fundamental Course vs Technical Trading Course

Technical courses focus on chart patterns and indicators. A forex fundamental analysis course focuses on the economic reality behind price movement.

Professional traders combine both approaches. However, without mastering fundamental in forex, technical signals lack conviction. That’s why serious traders start by building forex trading fundamentals before refining execution skills.

Who Should Take a Forex Fundamental Course?

A forex fundamental course is ideal for:

- Beginners building structured foundations

- Intermediate traders seeking consistency

- Technical traders needing macro direction

- Long-term traders focused on currency trends

If your goal is to trade with institutional-style logic, learning currency trading fundamentals through a forex fundamental analysis course is essential.

Advanced Forex Trading Fundamental Analysis

Advanced traders apply forex trading advanced fundamental analysis to:

- Track interest rate cycles

- Identify macroeconomic regime shifts

- Anticipate central bank turning points

- Build long-term currency portfolios

This level of analysis separates professional macro traders from short-term speculators.

Can You Learn Forex Fundamental Analysis Online?

Yes. Online forex fundamental analysis courses allow traders to study macroeconomic theory, real data examples, and live market conditions remotely.

Modern programmes update content as global economic cycles change, ensuring students stay aligned with current forex fundamentals.

How Long Does It Take to Learn Forex Fundamentals?

Core forex trading fundamentals can be learned within weeks. However, mastering understanding fundamental analysis in forex is ongoing, because economic regimes, inflation cycles, and interest rate environments constantly evolve.

The best courses teach both theory and adaptive decision-making.

Practical Example from a Forex Fundamental Analysis Learning

A student analyses:

- US inflation rising faster than expected

- The Federal Reserve signalling rate hikes

- European growth slowing

- The ECB signalling caution

Trade bias: USD strength versus EUR weakness.

This process shows how a forex fundamental analysis course converts economic data into actionable currency trading fundamentals.

FAQs

What is a forex fundamental analysis online course?

A forex fundamental analysis course teaches traders how to analyse economic data, central bank policy, and macro drivers to forecast currency direction. It builds forex trading fundamentals and structured decision-making skills.

Can beginners learn forex fundamental analysis?

Yes. Beginners can learn forex fundamental analysis by studying economic indicators, central bank decisions, and currency relationships. A structured forex fundamental education accelerates understanding fundamental analysis in forex.

What is a forex fundamental course?

A forex fundamental course is training focused on macroeconomic analysis, central bank interpretation, and currency valuation. It develops currency trading fundamentals rather than relying on chart indicators alone.

What is forex trading advanced fundamental analysis?

Forex trading advanced fundamental analysis involves tracking interest rate cycles, macroeconomic regimes, and policy shifts to build long-term currency strategies. It is used by institutional and professional traders.

Is there a forex fundamental analysis pdf available?

Many education providers offer downloadable study materials or a forex fundamental analysis course pdf to support offline learning. These resources help reinforce forex trading fundamentals and structured macro analysis.