Introduction

Fundamental indicators forex analysis is the professional method used to evaluate currencies by analysing macroeconomic data, monetary policy, and cross-border capital flows rather than price patterns alone. This approach is essential for traders who want to understand why exchange rates move and how durable trends form. In institutional FX markets, fundamentals determine direction, volatility regimes, and long-term conviction.

Fundamental indicators in forex are macroeconomic, monetary, and financial data points used to assess a currency’s underlying strength and forecast its future directional bias.

What Are Fundamental Indicators in Forex?

Fundamental indicators measure the real economic forces that drive currency valuation. Unlike technical indicators, they focus on economic conditions, policy decisions, and capital allocation rather than historical price behaviour.

Professional traders use fundamentals to identify whether a currency is structurally strong or weak. As a result, fundamental analysis forms the backbone of medium- and long-term forex market decision-making.

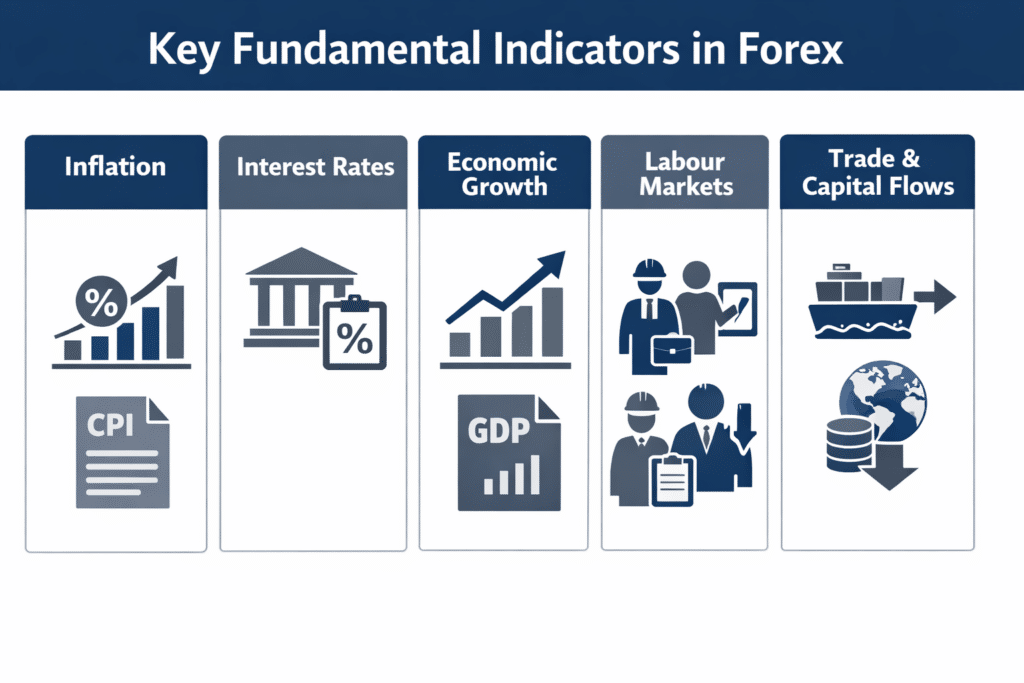

At a macro level, these indicators fall into five core categories: inflation, interest rates, economic growth, labour markets, and external balances.

Core Forex Fundamental Analysis Indicators

Inflation Indicators

Inflation determines purchasing power and strongly influences central bank policy.

The most closely watched inflation indicators include consumer price inflation, core inflation measures that exclude volatile components, and producer-level pricing data. Persistent inflation above target usually supports a currency if it forces tighter monetary policy. Conversely, falling inflation weakens yield support and long-term currency demand.

Central banks such as the Federal Reserve and the European Central Bank explicitly anchor policy decisions to inflation dynamics.

Interest Rates and Monetary Policy

Interest rates are the single most powerful driver of forex trends.

Key indicators include policy rates, forward guidance, yield curves, and bond-market expectations. Currencies with higher real yields tend to attract capital inflows, strengthening over time.

Policy divergence between central banks is one of the most reliable sources of sustained forex trends, as documented by institutions such as the Bank for International Settlements.

Economic Growth Indicators

Growth data measures economic resilience and expansion capacity.

Traders focus on GDP growth, business surveys such as PMI data, and industrial production. Stronger growth supports a currency by improving investment returns, fiscal sustainability, and employment conditions.

However, growth only strengthens a currency when it does not trigger excessive inflation or financial instability.

Labour Market Indicators

Labour data provides insight into economic momentum and inflation risk.

Key indicators include unemployment rates, employment growth, and wage inflation. Tight labour markets often precede rising inflation, reinforcing expectations of higher interest rates.

In major economies, labour data is a core input into central bank reaction functions.

Trade Balance and Capital Flows

External balances influence long-term currency valuation.

Trade balances, current account positions, and foreign direct investment flows determine whether an economy is structurally funded by external capital. Persistent deficits can weaken a currency unless offset by reserve-currency status or strong capital inflows.

The International Monetary Fund regularly highlights external balances as a key determinant of currency sustainability.

Forex Fundamental Data and How It Is Used

Forex fundamental data is never analysed in isolation by professionals. Instead, data is interpreted through the lens of policy response, trend persistence, and relative performance.

A single data release matters far less than its impact on interest-rate expectations, growth-inflation trade-offs, and cross-currency yield differentials. Consistency across multiple data series carries far greater forecasting weight than short-term surprises.

Forex Fundamental Forecasting Explained

Building a Fundamental Forecast

A forex fundamental forecast combines data analysis with scenario planning rather than prediction.

The professional process typically involves identifying macro trends, assessing central bank bias, comparing relative currency strength, evaluating global risk conditions, and mapping policy divergence. Forecasts are probability-based and continuously updated as data evolves.

The Importance of Relative Analysis

Currencies are always traded in pairs, not in isolation.

Even strong economic data may fail to support a currency if the opposing economy performs better. Relative growth, inflation, and interest-rate expectations determine directional bias, not absolute conditions.

This relative framework underpins institutional FX strategy.

Forex Market Fundamental Analysis in Practice

Consider a scenario where one economy shows rising inflation, strong labour data, and hawkish central bank communication, while the opposing economy experiences slowing growth and falling inflation.

Over time, this divergence typically produces trending currency behaviour rather than range-bound price action. These dynamics are consistent with historical analysis from the BIS and major central banks.

Professional Workflow for Fundamental Forex Analysis

Institutional analysts follow disciplined routines to maintain consistency.

This includes tracking macro releases weekly, monitoring central bank communications, maintaining relative scorecards across currencies, aligning fundamentals with global risk sentiment, and validating bias using market pricing.

This workflow reduces emotional decision-making and improves long-term performance.

Common Mistakes in Forex Fundamental Analysis

Retail traders often misuse fundamental indicators.

Common mistakes include trading single data releases in isolation, ignoring central bank reaction functions, mixing short-term technical trades with long-term macro bias, and failing to assess relative currency strength.

Avoiding these errors materially improves forecast reliability.

How Fundamental Analysis Complements Technical Analysis

Fundamentals define direction, while technicals define execution.

When macro bias aligns with price structure, conviction increases, holding periods extend, and risk-reward improves. This integrated approach mirrors how professional FX desks operate.

FAQs

What are the most important fundamental indicators in forex?

The most important indicators are inflation data, interest rates, GDP growth, labour market statistics, and trade balances. These factors directly influence central bank policy and capital flows, which drive long-term currency trends more reliably than short-term price movements.

How reliable is forex fundamental forecasting?

Forex fundamental forecasting is probabilistic rather than predictive. Reliability increases when multiple indicators align in one direction, but unexpected policy shifts or geopolitical events can always change outcomes. Scenario-based analysis is therefore essential.

Is fundamental analysis better than technical analysis in forex?

Fundamental analysis is superior for identifying long-term direction, while technical analysis is more effective for timing entries and exits. Professional traders combine both approaches rather than relying on one alone.

How often should forex fundamental data be reviewed?

Key macroeconomic data should be reviewed weekly, while inflation trends and central bank communication require continuous monitoring due to their direct impact on interest-rate expectations.

Can beginners use forex fundamental indicators effectively?

Beginners can use fundamental indicators by focusing on broad trends such as inflation direction, interest-rate policy, and growth momentum rather than reacting to individual data releases.