Introduction

Forex fundamental news is the foundation of professional currency analysis, explaining why exchange rates move rather than simply how they move. Traders searching for forex daily news fundamental analysis want structured, macro-driven insight into how economic data, central banks, and global events influence currencies each day. This article delivers a fully optimised, institutional-grade guide to daily fundamental analysis forex traders use to build directional bias, manage risk, and stay aligned with global macro conditions.

Definition Snippet

Forex fundamental news is the daily macroeconomic analysis of data releases, central bank policy, and global events to assess the underlying value and directional bias of currencies.

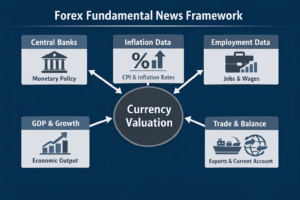

What Forex Fundamental News Covers

Forex news fundamental analysis focuses on structural drivers that consistently move currencies over days, weeks, and months. These forces determine relative currency strength rather than short-term price fluctuations.

Core components include:

- Central bank monetary policy and interest rate expectations

- Inflation trends and real yield differentials

- Economic growth indicators such as GDP and PMIs

- Labour market strength and wage dynamics

- Trade balances, current accounts, and capital flows

- Fiscal policy credibility and political stability

Together, these factors form the macro foundation of currency valuation.

Why Daily Forex Fundamental Analysis Matters

Currencies are continuously repriced as new information becomes available. Therefore, daily fundamental analysis forex professionals perform is about updating probabilities, not predicting isolated outcomes.

Daily analysis allows traders to:

- Adjust macro bias as new data alters expectations

- Reprice interest rate and yield differentials

- Identify regime shifts early

- Filter out technically attractive but fundamentally weak setups

Without a daily macro framework, traders rely on noise rather than conviction.

Key Inputs in Forex Daily News Fundamental Analysis

Central Bank Policy and Communication

Interest rates are the dominant driver of currency trends. Daily analysis tracks policy statements, voting patterns, forward guidance, and balance sheet actions to understand future rate paths.

Inflation Data

Inflation determines real interest rates. Persistent inflation supports tighter policy and currency strength, while disinflation or deflation weakens yield support.

Labour Market Releases

Employment growth, unemployment rates, and wage inflation signal domestic demand strength and future inflation pressure.

Economic Growth Indicators

GDP, PMIs, and business confidence surveys reveal whether an economy is expanding or contracting, shaping medium-term currency performance.

Trade and Capital Flows

Current account balances and foreign investment flows influence long-term currency demand and structural valuation.

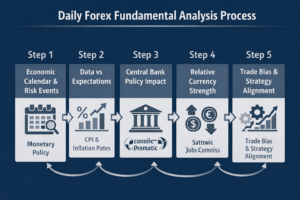

A Professional Workflow for Daily Fundamental Analysis Forex Traders Use

Step 1: Map Scheduled Risk Events

Identify high-impact data releases and central bank appearances before the trading day begins.

Step 2: Compare Data to Expectations

Markets move on surprises, not headlines. Analyse results relative to consensus forecasts and positioning.

Step 3: Reprice Policy Expectations

Assess whether new information alters the expected path of interest rates or monetary policy.

Step 4: Rank Relative Currency Strength

Determine which currencies gain or lose macro support on a relative basis.

Step 5: Align With Global Risk Conditions

Risk-on or risk-off environments can amplify or suppress fundamental signals.

Example of Daily Forex Fundamental News in Practice

Assume US inflation prints above expectations while Eurozone PMIs contract. The macro implications are clear:

- The Federal Reserve faces renewed inflation pressure

- The European Central Bank confronts slowing growth

- Yield differentials widen in favour of the US dollar

This creates a sustained directional bias rather than a short-term reaction.

Fundamental Analysis vs Forex News Headlines

Raw forex news reports what happened. Forex fundamental news explains why it matters and how long the impact may last.

- Headlines focus on events; fundamentals focus on implications

- News is immediate; fundamentals are cumulative

- Headlines react; fundamentals contextualise

This distinction separates professional analysis from retail commentary.

Common Mistakes in Forex News Fundamental Analysis

Many traders misuse fundamentals due to poor structure rather than lack of information.

- Trading headlines without macro context

- Ignoring market expectations and positioning

- Overweighting low-importance data

- Mixing long-term fundamentals with short-term noise

Professional analysis is selective, disciplined, and repeatable.

How Forex Fundamental News Integrates With Trading Strategy

Fundamentals define what to trade and in which direction. Technical analysis then determines when to trade.

- Strong fundamentals with bullish structure support trend continuation

- Strong fundamentals with corrective price action create pullback entries

- Weak fundamentals with technical breakdowns signal trend reversals

This integration creates durable trading conviction.

Institutional Context and Authority

Global FX markets are driven by central banks and international institutions such as the Federal Reserve, European Central Bank, IMF, World Bank, and BIS. Professional traders monitor these bodies daily because policy coordination, capital flows, and macro cycles determine long-term currency behaviour.

Understanding forex fundamental news means understanding how global macro forces interact across economies.

FAQs

What is the difference between forex news and forex fundamental news?

Forex news reports events, while forex fundamental news analyses how those events affect interest rates, growth expectations, and currency valuation. Fundamental analysis focuses on impact, duration, and macro significance rather than headlines.

How often should traders perform daily forex fundamental analysis?

Professional traders review fundamentals every trading day, even when no major data is released. Expectations evolve continuously, and daily review prevents reactive decision-making.

Can beginners use forex daily news fundamental analysis effectively?

Yes, by focusing on central bank policy and high-impact data rather than every headline. A structured framework simplifies complexity and improves decision quality.

Is forex fundamental analysis better than technical analysis?

They serve different purposes. Fundamentals establish directional bias, while technical analysis refines entries and exits. Used together, they form a robust trading process.

Why do currencies sometimes move opposite to fundamental news?

Markets price expectations in advance. When data meets or disappoints relative to forecasts, prices may reverse despite positive headlines. Context and positioning matter more than the news itself.