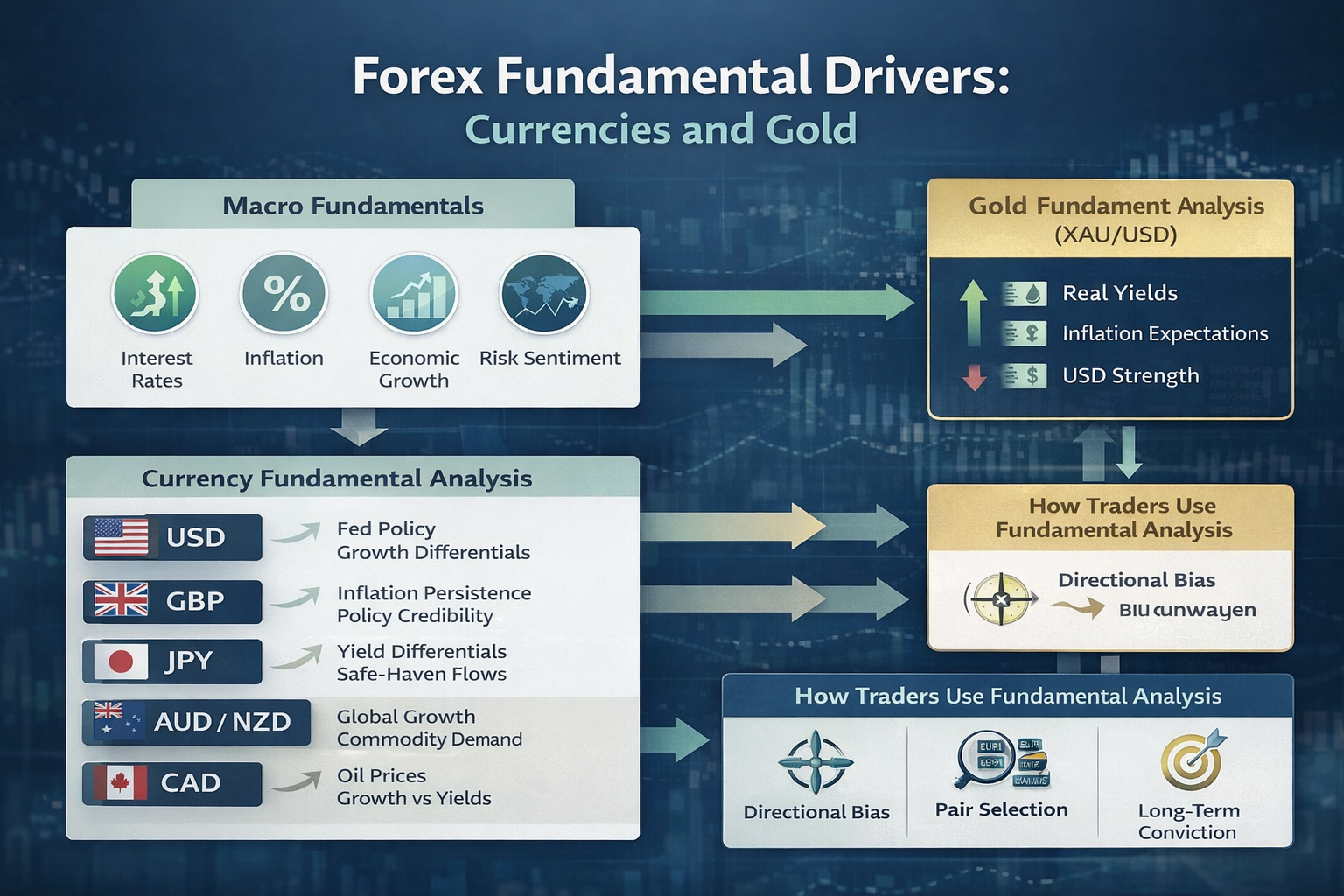

Forex fundamental analysis is the study of macroeconomic forces that drive currencies, major FX pairs, and macro-linked assets such as gold. Traders searching for usd fundamental analysis, gbp fundamental analysis, aud usd fundamental analysis, or xau usd fundamental analysis are typically trying to understand why markets trend over weeks and months rather than reacting to short-term price noise. This article delivers a complete, trader-focused framework covering USD, GBP, AUD, NZD, JPY, and gold fundamentals, while also explaining how forex fundamental analysis news, tools, websites, and indicators are used in practice.

Forex fundamental analysis is the process of analysing economic data, monetary policy, and macro drivers to determine the long-term direction of currencies and macro assets such as gold.

USD Fundamental Analysis and Major Dollar Pairs

USD fundamental analysis sits at the core of global FX markets. The US dollar reflects relative growth, inflation trends, labour market strength, and above all Federal Reserve policy. Because the USD is the world’s reserve currency, changes in US fundamentals ripple across risk assets, commodities, and global capital flows.

USD/CAD Fundamental Analysis

USDCAD fundamental analysis focuses on relative growth, interest rate expectations, and energy prices. Strong US data combined with weaker Canadian growth or falling oil prices typically supports USD/CAD. Conversely, rising oil prices and a hawkish Bank of Canada often strengthen the CAD side of the pair.

USD/CHF Fundamental Analysis

USDCHF fundamental analysis is heavily influenced by interest rate differentials and global risk sentiment. The Swiss franc acts as a defensive currency, so USD/CHF often weakens during risk-off periods even when US data remains firm.

USD/JPY Fundamental Analysis

USDJPY fundamental analysis and broader usdjpy fundamentals are driven by yield differentials and Bank of Japan policy. Persistent divergence between US and Japanese interest rates has historically produced sustained USD/JPY trends, particularly during global risk-on phases.

GBP Fundamental Analysis and Sterling Pairs

GBP fundamental analysis reflects the UK’s sensitivity to inflation, growth volatility, and policy credibility. Sterling often reacts sharply to changes in economic outlook and central bank communication.

GBP/USD Fundamental Analysis

GBPUSD fundamental analysis compares UK inflation persistence and growth momentum with US conditions. Long-term GBP/USD trends typically emerge when monetary policy expectations between the Bank of England and the Federal Reserve diverge meaningfully.

GBP/JPY Fundamental Analysis

GBPJPY fundamental analysis combines sterling volatility with yen sensitivity to risk sentiment. GBPJPY fundamentals often amplify moves during shifts in global risk appetite, making it a favoured pair for macro-driven traders.

GBP Fundamental Outlook

The gbp fundamental outlook depends on inflation dynamics, wage growth, fiscal credibility, and the Bank of England’s ability to manage price stability without undermining growth. Shifts in confidence can lead to prolonged sterling trends.

AUD, NZD, and JPY Fundamental Analysis

Asia-Pacific and commodity-linked currencies are closely tied to global growth and risk conditions.

AUD/USD Fundamental Analysis

AUDUSD fundamental analysis is influenced by China-linked growth expectations, commodity demand, and interest rate differentials. AUD typically performs well during periods of strong global growth and risk-on sentiment.

NZD/USD Fundamental Analysis

NZDUSD fundamental analysis reflects domestic inflation, growth trends, and risk appetite. NZD fundamental analysis often aligns with AUD drivers but can diverge based on local data and central bank policy differences.

CAD/JPY and JPY Fundamental Analysis

CADJPY fundamental analysis blends commodity exposure with yield differentials, making it highly sensitive to global risk cycles. Broader jpy fundamental analysis remains anchored to ultra-loose Japanese monetary policy and safe-haven capital flows.

Gold and Macro Asset Fundamental Analysis

Gold occupies a unique position within forex fundamental analysis, acting as a macro asset rather than a traditional currency.

XAU/USD Fundamental Analysis

XAUUSD fundamental analysis centres on real yields, inflation expectations, and US dollar strength. Gold tends to benefit when real yields fall and the USD weakens, while rising real yields often pressure prices.

Inflation and Gold Fundamentals

Inflation and gold fundamentals are closely linked through monetary policy expectations. Gold typically performs best when inflation is high and central banks lag behind, eroding real purchasing power.

Real Yields and Gold

Real yields and gold have a strong inverse relationship. When real yields decline, the opportunity cost of holding gold falls, supporting prices.

USD Drivers vs Gold

USD drivers vs gold reflect a balancing act between currency strength and yield dynamics. A strong USD can weigh on gold, but falling real yields can offset dollar strength.

Forex Fundamental Analysis News, Tools, and Indicators

Traders rely on more than theory to apply fundamentals effectively.

Forex Fundamental Analysis News

Forex fundamental analysis news includes economic releases, central bank decisions, and geopolitical developments. Markets move on expectations, so context matters more than individual data points.

Forex Fundamental Analysis Tools and Websites

A forex fundamental analysis website or platform typically aggregates macro data, calendars, yield curves, and central bank guidance. Forex fundamental analysis tools help traders track changes in expectations consistently rather than reacting emotionally.

Forex Fundamental Analysis Indicators

Forex fundamental analysis indicators differ from technical indicators. They include interest rate differentials, inflation trends, growth momentum, and balance-of-payments data, all used to support directional bias.

How Traders Use Fundamental Analysis in Practice

Fundamentals define what to trade and in which direction. Technical analysis refines timing and risk management. Traders who integrate both approaches develop stronger conviction and consistency than those relying on either method alone.

Internal linking opportunities fit naturally here around deeper guides on USD fundamentals, GBP outlook analysis, and gold macro drivers.

Frequently Asked Questions

What is USD fundamental analysis

USD fundamental analysis examines US growth, inflation, labour data, and Federal Reserve policy to determine the long-term direction of the US dollar against other currencies.

How does gold fit into forex fundamental analysis

Gold is analysed using macro drivers such as real yields, inflation expectations, and USD strength, making it a key macro asset within forex fundamental analysis.

Which GBP pair is best for fundamental analysis

GBP/USD is best for policy divergence analysis, while GBP/JPY is more sensitive to global risk sentiment and yield differentials.

Are fundamental forex indicators better than technical indicators

Fundamental indicators define direction and conviction, while technical indicators improve timing. Professional traders use both together.

Do forex fundamental analysis tools replace analysis

No. Forex fundamental analysis tools organise data, but traders must interpret macro relationships and narratives to make informed decisions.