A currency strength analysis platform is foundational to professional FX trading because currencies never move in isolation. Every FX trade expresses a relative relationship between two economies, two policy paths, and two positions within the global risk cycle. For that reason, professional traders do not ask whether a currency will rise or fall. Instead, they assess which currencies are strengthening relative to others and, crucially, why that shift is occurring.

A currency strength analysis platform is a professional FX tool that measures and compares the relative strength of currencies using macroeconomic data, policy dynamics, and risk context to support structured, high-conviction trading decisions.

Why Currency Strength Is Foundational to FX Trading

FX is a relative market by design. When you trade EUR/USD, you are not trading the euro in isolation. Rather, you are trading the euro relative to the US dollar. Because of this structure, analysing a single currency without its counterpart leads to incomplete conclusions.

Professional FX traders rely on currency strength analysis because it solves three structural problems.

First, it enforces relative thinking, which naturally produces higher-probability trades by pairing strong currencies against weak ones.

Second, it aligns analysis with macro reality, since currencies strengthen or weaken due to growth differentials, inflation paths, labour conditions, trade balances, and policy divergence.

Finally, it reduces overtrading. When strength dispersion is limited, professionals wait. When dispersion widens, opportunity increases.

Without currency strength analysis, traders frequently mistake volatility for opportunity.

Indicator-Based vs Macro-Driven Currency Strength Models

Not all currency strength models provide meaningful insight. The methodology behind the model determines whether its output adds clarity or noise.

Indicator-Based Currency Strength Models

Indicator-based models derive currency strength from price behaviour alone. Common inputs include RSI, moving averages, momentum oscillators, and aggregated pair performance.

Although these models are fast and intuitive, they suffer from structural weaknesses. They measure what has already happened rather than why it occurred. In addition, they react strongly to short-term volatility and often fail during regime transitions.

As a result, indicator-based currency strength indicators function best as tactical tools rather than strategic foundations.

Macro-Driven Currency Strength Models

Macro-driven models assess currency strength using economic and policy fundamentals. Instead of relying on recent price action, these models evaluate the underlying forces driving currency behaviour.

Typical inputs include inflation and monetary policy stance, economic growth trends, labour market conditions, trade dynamics, and fiscal balance considerations. Because these variables evolve gradually, macro-driven currency strength models provide stability, context, and forward-looking insight.

For this reason, professional FX desks anchor their analysis in macro strength rather than indicators.

How Professionals Use Relative Currency Strength

Professional traders do not use currency strength to predict exact price levels. Instead, they use it to structure decisions and prioritise opportunities.

The process typically follows a disciplined sequence.

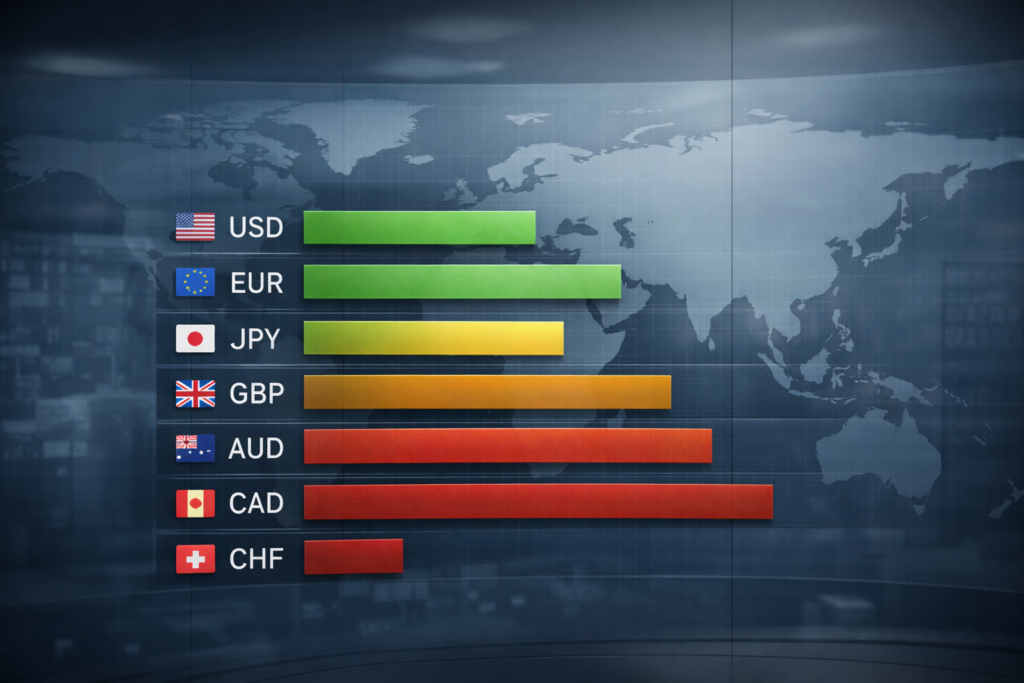

First, currencies are ranked from strongest to weakest using a normalised model.

Next, traders focus on dispersion rather than absolute values.

After that, they construct pairs by matching strong currencies against weak ones.

Finally, they assess whether the prevailing global risk regime supports the expression of that relative view.

This approach removes the need to forecast tops or bottoms while aligning trade construction with macro reality instead of opinion.

Data Normalisation: The Core of Professional Currency Strength Analysis

Raw macro data cannot be compared directly across economies. An inflation rate of 5% carries very different implications depending on historical context, economic structure, and policy credibility. Similarly, GDP growth figures vary in significance across countries.

Therefore, data normalisation becomes essential.

A professional currency strength analysis platform normalises data by standardising metrics across economies, adjusting for historical ranges and volatility, weighting indicators by FX relevance, and converting raw inputs into comparable scores. As a result, traders focus on trend and relative direction rather than reacting to headline figures.

Without normalisation, large numbers distort perception and obscure structural shifts.

Weighting Logic: Not All Data Matters Equally

Professional currency strength modelling tools do not treat all data equally. Instead, weighting reflects how markets actually respond.

For FX purposes, monetary policy and inflation typically carry more weight than sentiment surveys. Likewise, growth trends matter more than single GDP prints, while labour data matters primarily through its influence on policy. Trade balances also matter, but only when imbalances persist over time.

This weighting logic reflects market sensitivity rather than academic importance. That distinction separates tradable models from theoretical ones.

Currency Strength Indicators vs Currency Strength Platforms

Many traders mistakenly treat indicators and platforms as interchangeable.

A currency strength indicator usually relies on price-based inputs, operates on short timeframes, and provides tactical signals. In contrast, a currency strength analysis platform integrates macro data, policy divergence, and risk context to support repeatable decision-making across regimes.

Indicators can assist with timing. Platforms define bias, conviction, and pair selection.

FX Currency Strength Software Across Market Regimes

Currency strength behaves differently depending on the prevailing regime.

In risk-on environments, growth-sensitive and higher-yielding currencies often strengthen together. Conversely, in risk-off conditions, defensive and funding currencies tend to outperform regardless of growth data.

Professional FX currency strength software adapts to these shifts by embedding regime awareness. Without this layer, strength rankings can become misleading at precisely the wrong time.

Example: Currency Strength in a Live Macro Environment

Assume inflation remains persistent in the United States, leading the Federal Reserve to maintain a restrictive stance. At the same time, growth weakens in the euro area and the ECB signals easing. Meanwhile, global risk sentiment deteriorates as equity volatility rises.

In this environment, a macro-driven currency strength model would typically show USD strengthening relative to EUR, defensive currencies outperforming growth-sensitive ones, and dispersion widening between strong and weak currencies.

Rather than predicting an exact EUR/USD level, a professional trader recognises that the relative structure favours USD strength and constructs trades accordingly.

Common Mistakes in Currency Strength Analysis

Treating Currency Strength as a Signal

Currency strength defines bias, not entry timing. Confusing the two leads to premature execution.

Ignoring Regime Context

Strength rankings without regime awareness break down when correlations shift.

Overweighting Short-Term Moves

Short-term volatility can distort rankings if models lack smoothing and normalisation.

Using Price-Based Models for Macro Decisions

Indicators react. Macro strength explains.

Final Perspective

Currency strength analysis is not a shortcut or a technical trick. It is the structural foundation of professional FX trading.

A robust currency strength analysis platform aligns analysis with how currencies actually move: through relative macro forces, policy divergence, and regime context. When traders stop predicting and start comparing, decision quality improves and noise falls away.

That is why currency strength sits at the centre of institutional FX workflows.

FAQs

What is a currency strength analysis platform?

A currency strength analysis platform ranks and compares currencies using macroeconomic drivers, policy dynamics, and relative performance to help traders align strong currencies against weak ones.

How do macro-driven currency strength models differ from indicator-based models?

Macro-driven models assess underlying economic and policy strength, while indicator-based models rely on price action. Macro models provide stability and context, whereas indicators assist with short-term timing.

Why do professional traders focus on relative currency strength?

Because FX is a relative market, professionals focus on relative strength to improve probability, reduce directional bias, and align trades with macro forces rather than short-term price noise.

Are currency strength indicators useful?

Yes, but tactically. Indicators help with timing once a macro bias is established, but they do not replace a macro-driven currency strength framework.

How does data normalisation improve currency strength analysis?

Normalisation converts raw macro data into comparable signals across economies, reducing noise and preventing overreaction to isolated data points. This allows traders to assess relative strength more accurately.