Introduction

The best forex fundamental analysis site helps traders understand the macroeconomic forces driving currency markets. Instead of relying on technical charts alone, traders use a forex fundamental analysis website to track interest rates, inflation, GDP, and central bank policy in real time. This guide explains how to identify the best website for forex fundamental analysis, what features matter most, and how professional traders use the best fundamental analysis sites forex to build high-conviction trading decisions.

Forex fundamental analysis websites turn economic data into structured currency insight.

Definition:

A forex fundamental analysis website is a platform that provides macroeconomic data, central bank updates, and currency-specific analysis to forecast market direction.

What Is a Forex Fundamental Analysis Website?

A forex fundamental analysis website is an online platform designed to monitor global economic data, central bank policy, and macroeconomic trends that influence currency valuation.

Unlike basic news feeds, the best site for fundamental analysis forex provides structured interpretation of data releases, forward-looking policy guidance, and comparative currency strength tools. These features help traders build real forex trading fundamentals instead of reacting emotionally to headlines.

Professional traders rely on specialised platforms because forex fundamentals require constant tracking and structured evaluation.

Why Traders Need the Best Forex Fundamental Analysis Site

Retail traders often fail because they trade without macro context. Using the best forex fundamental analysis site solves this problem.

A high-quality best website for forex fundamental analysis allows traders to:

- Track real-time economic data

- Interpret central bank communication

- Compare relative currency strength

- Anticipate market expectations

- Build structured trade bias

As a result, best fundamental analysis sites forex help traders move from speculation to disciplined decision-making.

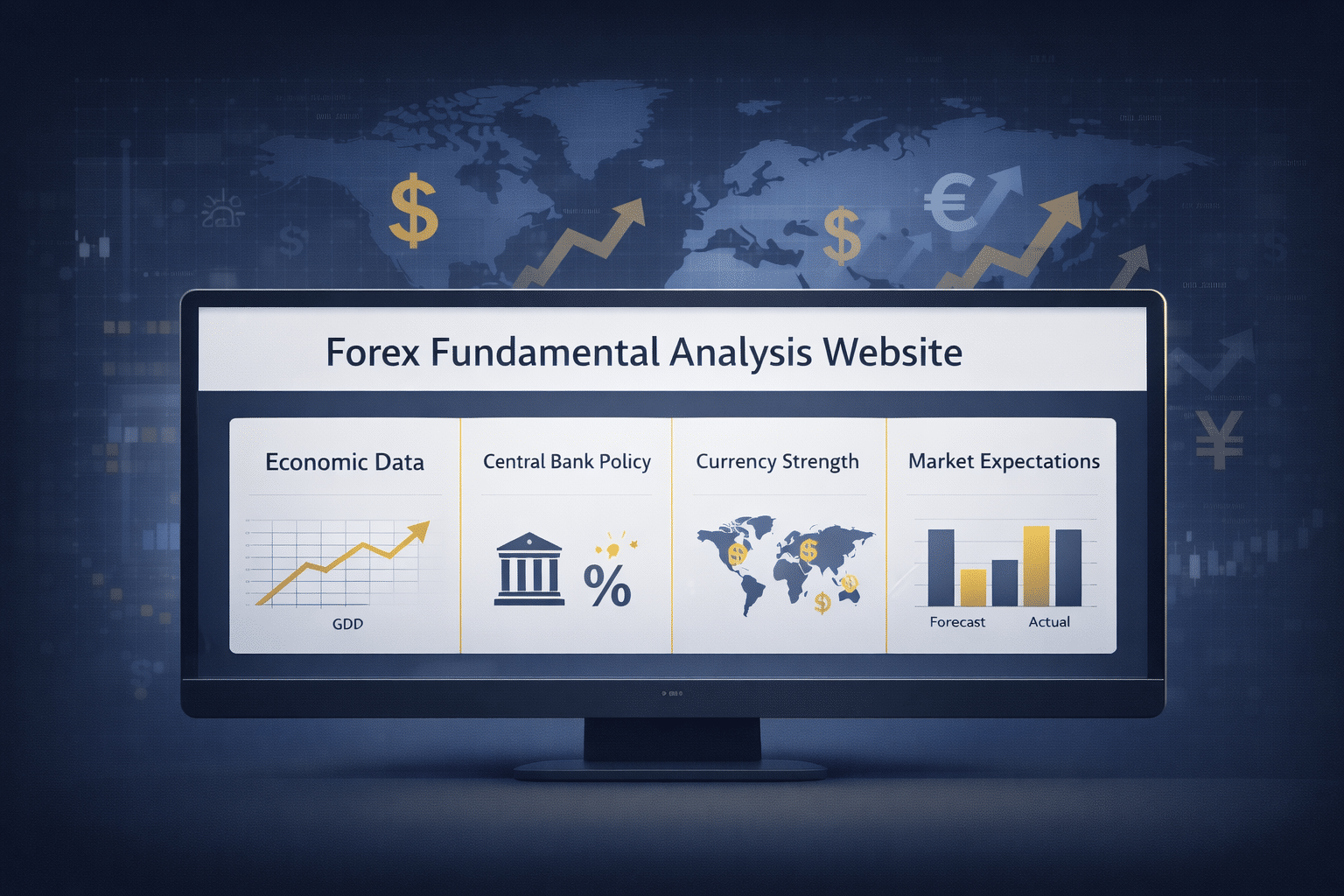

Core Features of the Best Website for Forex Fundamental Analysis

Real-Time Economic Data

Top platforms provide live inflation, GDP, employment, and trade balance updates. This is the backbone of any serious forex fundamental analysis website.

Central Bank Policy Tracking

The best website for fundamental analysis forex monitors interest-rate decisions, policy statements, and speeches from major central banks.

Market Expectation Tools

Professional platforms compare actual data against forecasts, revealing where surprises may move markets.

Relative Currency Strength Models

Advanced best forex fundamental analysis sites offer currency strength dashboards to visualise macro positioning.

Structured Analysis Frameworks

The strongest platforms transform raw data into actionable macro insight rather than just presenting information.

Best Fundamental Analysis Websites Forex vs News Websites

A news site reports events.

A forex fundamental analysis website interprets events.

That distinction is critical. The best website for forex fundamental analysis does not simply display headlines — it explains how economic developments alter currency valuation. This deeper structure is what professional traders require.

How to Choose the Best Forex Fundamental Analysis Site

When selecting the best forex fundamental analysis site, look for:

- Comprehensive global economic coverage

- Central bank policy interpretation

- Data visualisation dashboards

- Historical macro trend tracking

- Clear, repeatable analytical frameworks

If a platform lacks structured macro interpretation, it is not a true best website for fundamental analysis forex.

Who Uses Forex Fundamental Analysis Websites?

- Professional macro traders

- Hedge fund analysts

- Long-term currency investors

- Retail traders seeking consistency

Anyone serious about currency trading benefits from using best fundamental analysis websites forex.

Practical Example of Using a Forex Fundamental Analysis Website

A trader checks a forex fundamental analysis website and sees:

- US inflation rising above expectations

- The Federal Reserve signalling tighter policy

- European growth slowing

- The ECB signalling caution

Trade bias: USD strength vs EUR weakness.

This process shows how the best website for forex fundamental analysis converts macro data into actionable insight.

Daily Routine Using the Best Site for Fundamental Analysis Forex

- Review overnight economic data

- Check central bank updates

- Assess market expectations

- Update currency strength view

- Align trades with macro bias

This workflow defines professional use of a best forex fundamental analysis website.

FAQs

What is the best forex fundamental analysis site?

The best forex fundamental analysis site is a platform that provides real-time economic data, central bank policy interpretation, and structured macro insight to forecast currency direction.

What makes the best website for forex fundamental analysis?

The best website for forex fundamental analysis combines global economic data, central bank tracking, relative currency strength tools, and structured analytical frameworks for building trade bias.

Is a forex fundamental analysis website better than a news website?

Yes. A forex fundamental analysis website interprets economic events and policy decisions, while a news website only reports them. Interpretation is essential for trading decisions.

How do traders use best fundamental analysis Websites forex?

Traders use best fundamental analysis sites forex to monitor macro data, compare currency strength, track central bank guidance, and align trades with long-term market direction.

Can beginners use a best site for fundamental analysis forex?

Yes. Beginners benefit from structured macro dashboards and guided interpretation available on a best site for fundamental analysis forex, helping them build forex trading fundamentals.