Forex fundamental analysis pdf–style resources and advanced texts appeal to traders who want to understand currency markets at a professional level, combining macroeconomic logic with practical trading application. Traders searching for combined fundamental and technical analysis forex approaches are usually moving beyond beginner material and want to analyse real currency pairs such as EUR/USD, EUR/GBP, and EUR/JPY using institutional-style frameworks. This article explains how advanced PDFs, combined fundamental and technical analysis, and currency pair–specific studies fit together into a coherent trading methodology.

Forex fundamental and technical analysis is the structured study of macroeconomic drivers, currency valuation, and price behaviour to form long-term directional bias and informed trading decisions across major and cross currency pairs.

Advanced Forex Fundamental Analysis PDFs and Author Texts

Many traders progress to advanced materials after covering basic fundamentals. Searches such as forex fundamental analysis david carli pdf or fundamental analysis forex trading techniques eugenio milani pdf indicate demand for deeper, more technical explanations of how macroeconomic variables translate into tradable bias.

High-quality author PDFs focus on process rather than signals. A strong forex fundamental analysis book pdf will typically cover interest rate differentials, inflation regimes, growth cycles, and balance-of-payments dynamics, then show how these factors influence currency valuation over time.

Resources such as forex fundamental analysis trade forex like a fund manager pdf appeal to traders seeking institutional perspective. These texts emphasise patience, narrative consistency, and macro confirmation rather than short-term prediction.

Combining Fundamental and Technical Analysis in Forex

Pure fundamentals explain direction, but price still matters. This is why many traders search for fundamental and technical analysis forex or technical and fundamental analysis in forex.

Why Fundamentals and Technicals Work Together

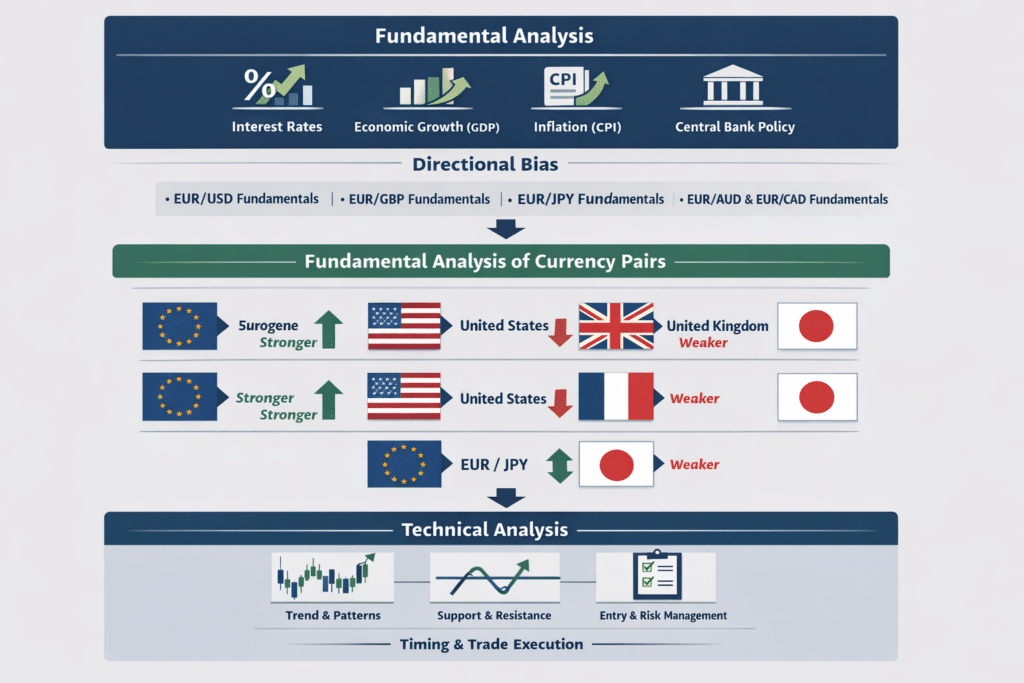

Fundamental analysis identifies which currencies should strengthen or weaken based on macro conditions. Technical analysis helps traders manage timing, risk, and execution.

A fundamental and technical analysis forex pdf often demonstrates how macro bias filters trades, while technical structure controls entries and exits. This reduces overtrading and improves consistency.

The Role of Signals in Fundamental Trading

Searches such as fundamental forex signals or fundamental trading signals often reflect a misunderstanding. In professional trading, fundamentals do not generate frequent signals. Instead, they create a directional framework within which selective trades are taken.

Fundamental analysis of forex pdf resources that promise constant signals should be treated with caution. High-quality material focuses on conviction and patience rather than frequency.

Fundamental Analysis of Major EUR Currency Pairs

Many traders move from theory to application by studying specific currency pairs. Euro pairs are particularly popular due to deep liquidity and clear macro drivers.

EUR/USD Fundamental Analysis

Searches for eurusd fundamental analysis or fundamental analysis of eur usd usually focus on interest rate divergence between the US and the euro area, inflation differentials, and relative growth expectations.

EUR USD fundamentals are driven by central bank policy expectations, capital flows, and global risk sentiment. Long-term trends often emerge when monetary policy paths clearly diverge.

EUR/GBP Fundamental Analysis

Eur gbp fundamental analysis focuses on relative economic performance between the euro area and the UK. Growth momentum, inflation persistence, and policy credibility play a central role.

Because EUR/GBP is less sensitive to global risk than EUR/USD, it is often favoured for pure relative-value fundamental analysis.

EUR/JPY Fundamental Analysis

Eur jpy fundamental analysis is heavily influenced by risk sentiment, yield differentials, and Japanese monetary policy. When global risk appetite shifts, EUR/JPY often reacts more sharply than other euro crosses.

EUR Crosses and Broader Currency Fundamentals

Beyond the majors, traders also analyse euro crosses and broader currency relationships.

EUR/AUD and EUR/CAD Fundamentals

Searches such as euraud fundamental analysis and eurcad fundamental analysis reflect interest in relative growth cycles and commodity exposure. These pairs often respond strongly to changes in global growth expectations and commodity demand.

Currency Fundamental Analysis Across Pairs

Currency fundamental analysis is inherently comparative. Fundamental analysis of currency pairs involves evaluating two economies side by side rather than analysing a currency in isolation.

Currency fundamental analysis books typically stress this relative framework, teaching traders to compare inflation trends, growth trajectories, labour markets, and policy outlooks across countries.

How to Study Advanced Fundamental Analysis Effectively

Advanced resources only add value when used correctly.

Build a Macro Narrative

Use forex fundamental analysis book pdf resources to understand the macro environment before looking at charts.

Apply Technical Structure Selectively

Use technical analysis to support, not override, the fundamental view.

Focus on Fewer Pairs

Studying a small set of currency pairs deeply is more effective than scanning dozens of markets superficially.

Frequently Asked Questions

Are advanced forex fundamental analysis PDFs suitable for retail traders

Yes. Advanced PDFs are suitable for retail traders who already understand basic macro concepts and want to adopt a more structured, long-term approach to currency analysis.

Can fundamental and technical analysis forex approaches be combined effectively

Yes. Fundamentals define direction and conviction, while technical analysis improves timing and risk management. Most professional traders combine both.

Do fundamental forex signals work for long-term trading

Fundamentals do not generate frequent signals. Instead, they provide a directional framework within which selective trades are taken over weeks or months.

Which euro pair is best for fundamental analysis

EUR/USD is best for global macro themes, EUR/GBP for relative-value analysis, and EUR/JPY for risk sentiment and yield-driven moves.

Are currency fundamental analysis books still relevant today

Yes. Despite algorithmic trading, long-term currency trends remain driven by macroeconomic forces, making currency fundamental analysis books highly relevant.