Introduction

Forex fundamentals explain why currency prices move. Instead of guessing direction, traders study economic forces that drive value. Understanding fundamental analysis in forex allows traders to interpret interest rates, inflation, growth, and central bank policy with confidence. This guide delivers a complete breakdown of forex fundamentals, forex trading fundamentals, and currency trading fundamentals, giving beginners and developing traders a clear foundation. If you want to master fundamental in forex and build long-term trading conviction, this is your definitive starting point.

Forex fundamentals are the macroeconomic and financial factors that determine the long-term value of currencies.

What Are Forex Fundamentals?

Forex fundamentals are the economic, financial, and political forces that influence currency value. When a country’s economy strengthens, its currency usually appreciates. When conditions weaken, its currency tends to decline.

Understanding fundamental analysis in forex means recognising these cause-and-effect relationships. Rather than reacting to short-term price fluctuations, traders who follow forex trading fundamentals focus on the underlying economic reality that drives trends. Currency trading fundamentals form the backbone of professional forex decision-making.

Why Forex Trading Fundamentals Matter

Price charts show what happened. Forex fundamentals explain why it happened.

Traders who ignore fundamental in forex rely on probability alone. However, traders who apply understanding fundamental analysis in forex can identify high-probability directional bias before technical confirmation appears.

Forex trading fundamentals help you identify long-term currency trends, avoid trading against macroeconomic forces, understand volatility around news events, and build conviction in market direction. As a result, currency trading fundamentals separate professional traders from short-term speculators.

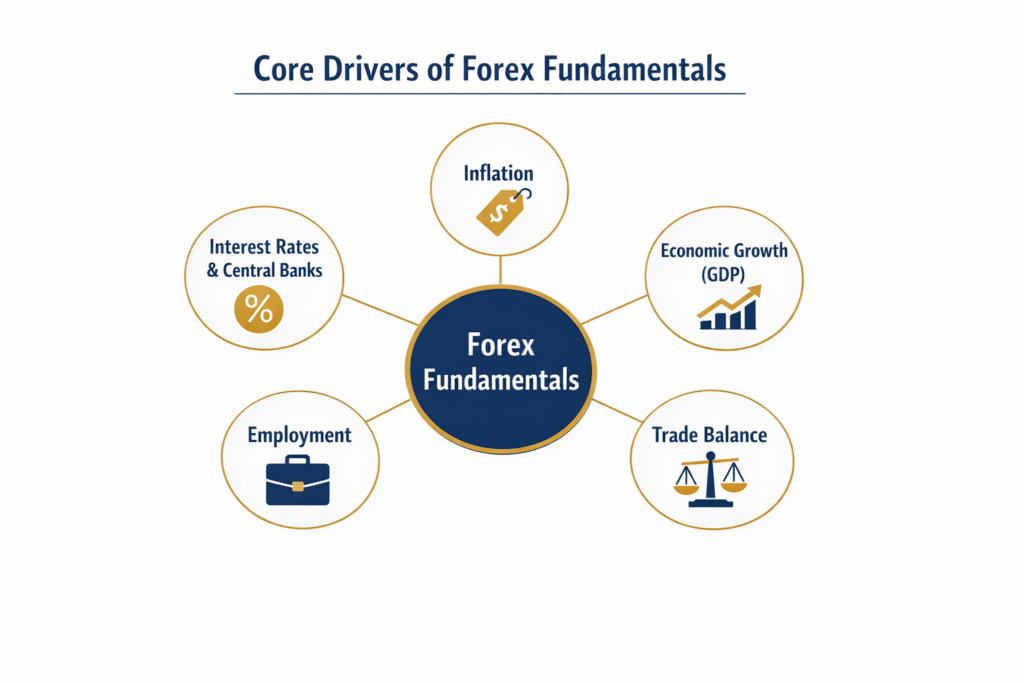

Core Drivers of Currency Value

Interest Rates and Central Banks

Interest rates are the most powerful forex fundamental driver. When a central bank raises rates, its currency usually strengthens due to higher capital returns. When rates fall, the currency weakens.

Institutions such as the Federal Reserve, European Central Bank, Bank of England, and Bank of Japan guide forex trading fundamentals through monetary policy statements and forward guidance.

Inflation

Inflation measures purchasing power. Rising inflation often leads to tighter monetary policy. Therefore, inflation data directly shapes understanding fundamental analysis in forex.

Economic Growth

GDP growth signals economic momentum. Strong growth attracts foreign investment and strengthens a currency. Weak growth reduces demand.

Employment

Low unemployment reflects economic health. Rising unemployment weakens confidence and currency demand.

Trade Balance

Countries with export surpluses generate sustained demand for their currency. Persistent deficits weaken long-term valuation.

Together, these forces form the foundation of forex fundamentals.

Understanding Fundamental Analysis in Forex

Fundamental analysis in forex compares the economic strength of one currency against another.

If US growth accelerates while European growth slows, USD strengthens against EUR. If UK inflation rises faster than Japan’s, GBP strengthens versus JPY.

Every forex trade expresses one currency’s strength against another’s weakness. That is why understanding fundamental analysis in forex always focuses on relative performance. This comparative process defines professional currency trading fundamentals.

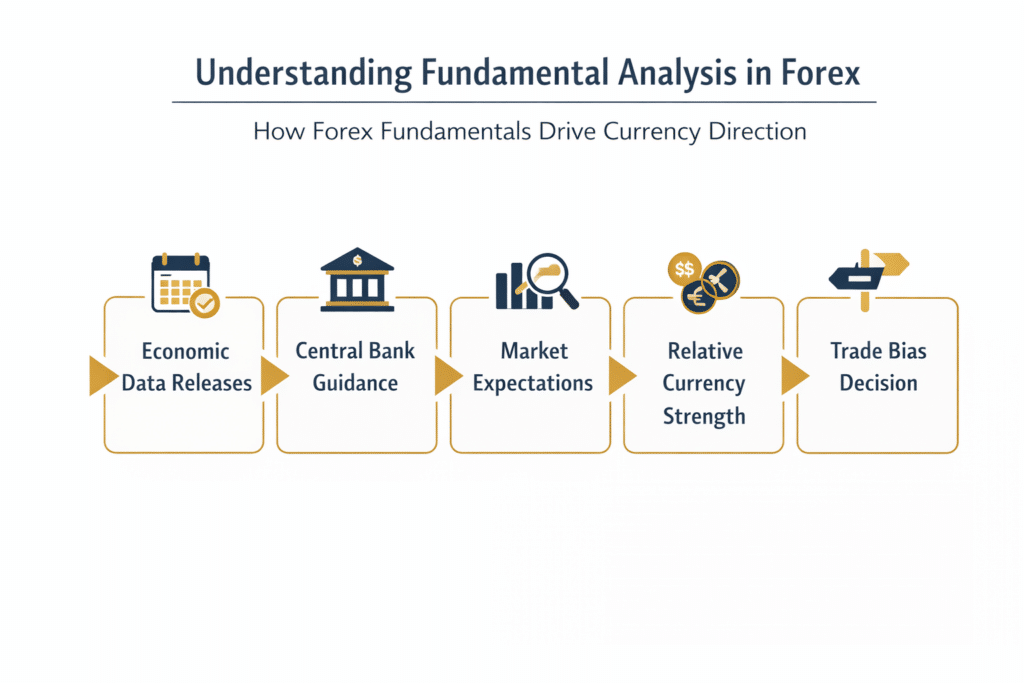

Step-by-Step Approach to Forex Fundamentals

Step 1: Monitor Economic Calendars

Track scheduled releases for inflation, GDP, employment, and interest rate decisions.

Step 2: Follow Central Bank Communication

Policy statements, meeting minutes, and speeches reveal future direction more than historical data.

Step 3: Compare Economic Momentum

Identify which economy is strengthening and which is slowing.

Step 4: Measure Market Expectations

Markets move on surprises. Compare actual data to forecasts.

Step 5: Build Trade Bias

Combine all inputs into a structured macro view. This completes fundamental in forex analysis and strengthens forex trading fundamentals.

Short-Term vs Long-Term Forex Fundamentals

Short-term fundamentals come from news events and data releases. They drive volatility over hours or days.

Long-term fundamentals come from interest rate cycles, inflation trends, and growth regimes. They drive trends lasting months or years.

Professional traders combine both horizons. This balance defines advanced currency trading fundamentals.

Common Mistakes Beginners Make

New traders often misunderstand fundamental in forex. Common errors include trading single news releases without context, ignoring central bank forward guidance, overreacting to short-term volatility, and neglecting relative currency comparison.

Successful traders follow structured understanding fundamental analysis in forex rather than emotional reactions.

How Forex Fundamentals Support Technical Analysis

Technical analysis identifies timing. Forex fundamentals define direction.

When both align, probability improves significantly. Therefore, professional forex trading fundamentals always integrate macro analysis with technical execution.

Practical Example of Currency Trading Fundamentals

Imagine US inflation rises while European growth slows.

The Federal Reserve signals tighter policy. The European Central Bank signals caution. Capital flows toward USD assets.

Outcome: USD strengthens and EUR weakens.

This chain demonstrates how understanding fundamental analysis in forex converts economic data into actionable trade bias.

Building a Daily Forex Fundamentals Routine

Check the economic calendar. Review overnight macro data. Read central bank commentary. Update currency strength outlook. Align trades with macro direction.

This daily structure strengthens discipline and consistency in forex fundamentals execution.

FAQs

What are forex fundamentals in simple terms?

Forex fundamentals are the economic and financial factors that determine currency value. They include interest rates, inflation, economic growth, employment, and central bank policy. Understanding these drivers helps traders anticipate long-term market direction rather than relying only on price charts.

What are forex trading fundamentals?

Forex trading fundamentals refer to analysing macroeconomic data, central bank policy, and economic indicators to determine currency direction. Traders use forex trading fundamentals to identify long-term trends and avoid trading against underlying market forces.

How do beginners learn currency trading fundamentals?

Beginners learn currency trading fundamentals by studying economic calendars, central bank decisions, inflation data, and GDP reports. Over time, they build understanding fundamental analysis in forex by comparing economic strength between countries.

Why do central banks matter in fundamental in forex?

Central banks control interest rates and monetary policy. Their decisions influence inflation expectations, investment flows, and currency demand. As a result, they are the most powerful driver of forex fundamentals.

Can understanding fundamental analysis in forex predict market moves?

Understanding fundamental analysis in forex identifies probable market direction rather than exact price levels. When combined with technical timing and market expectations, it significantly improves trading consistency and confidence.