Forex trading fundamental analysis is the process of valuing currencies by studying the economic and financial forces that move exchange rates. Instead of relying on short-term price patterns, traders analyse macroeconomic indicators, central bank policy, and global capital flows to understand why currencies rise or fall. Consequently, this approach forms the foundation of professional currency trading because it explains market direction rather than random price behaviour. In this guide, you will learn how forex trading fundamental analysis works, which economic drivers matter most, how professionals build repeatable frameworks, and how to apply macro logic to real trading decisions.

What Is Forex Trading Fundamental Analysis?

Forex trading fundamental analysis evaluates the underlying strength or weakness of an economy to determine its currency’s fair value. Every currency represents a national economic system. Therefore, when an economy strengthens, its currency generally appreciates. When conditions deteriorate, its currency typically depreciates.

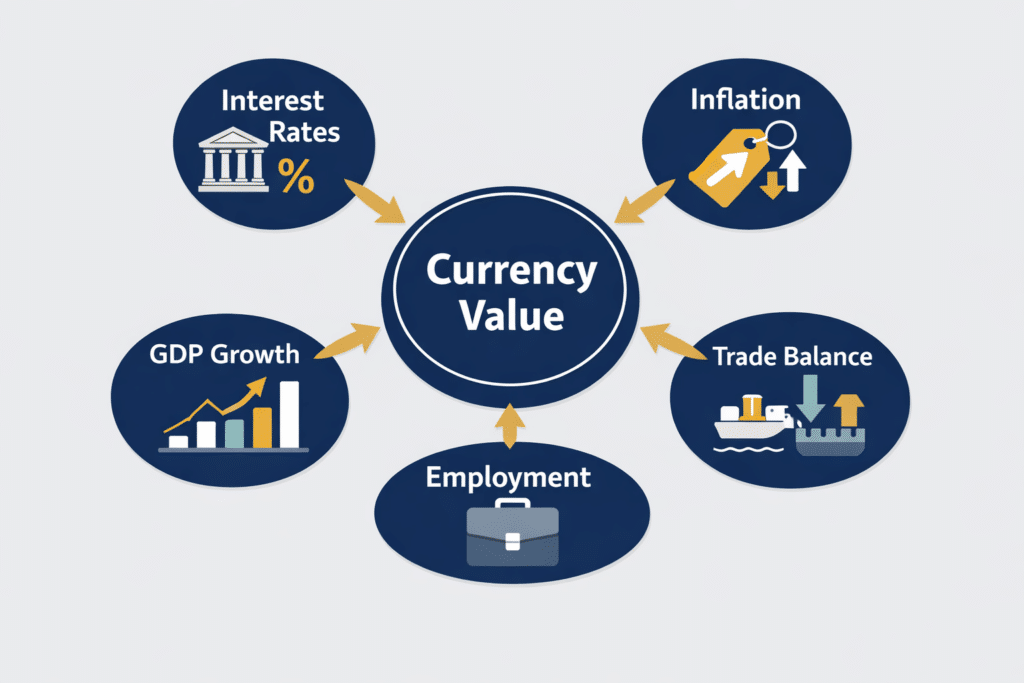

Fundamental analysis focuses on measurable data including interest rates, inflation, GDP growth, employment, trade balances, fiscal policy, and political stability. Traders interpret how these factors influence investment flows, capital allocation, and central bank actions.

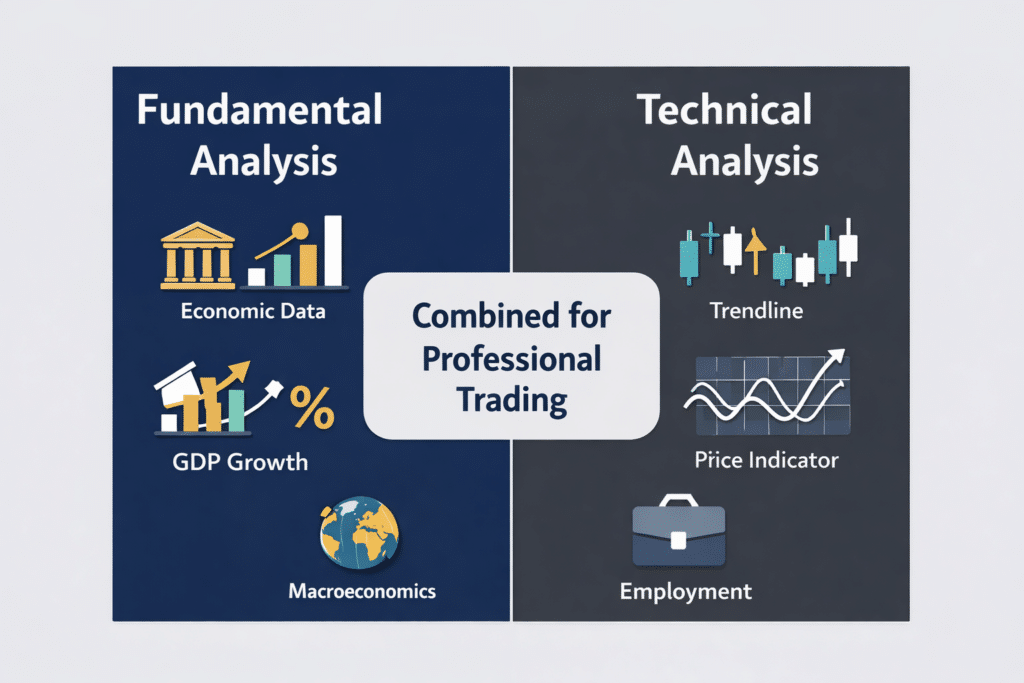

Unlike technical analysis, which studies price charts, forex trading fundamental analysis explains why trends develop in the first place. As a result, it provides long-term conviction and professional market context.

Why Fundamental Analysis Matters in Forex Trading

Currency markets reflect global capital movement. Investors constantly shift funds toward economies offering stronger returns, stability, and growth. Therefore, identifying these flows is essential.

Traders applying forex trading fundamental analysis gain three key advantages. First, they understand trend direction before it becomes visible on charts. Second, they avoid trading against dominant macroeconomic forces. Third, they manage risk more effectively by recognising regime shifts early.

Meanwhile, traders who ignore fundamentals often rely on noise. Professional traders succeed because they follow economic structure rather than short-term price reactions.

Core Economic Drivers in Fundamental Analysis

Macroeconomic indicators form the engine of currency valuation. Building a complete forex trading fundamental analysis framework requires understanding each driver.

Interest Rates and Monetary Policy

Interest rates are the most powerful influence on currency value. Higher rates attract foreign investment because investors earn better returns on deposits and bonds. Consequently, currencies with rising rate expectations tend to strengthen.

Central banks control interest rates through monetary policy. Traders study policy meetings, voting patterns, guidance statements, and yield curves to anticipate future moves. Importantly, expectations often move markets more than actual decisions.

Inflation and Price Stability

Inflation measures the rate at which prices rise. Moderate inflation reflects healthy growth. However, excessive inflation erodes purchasing power and threatens stability.

Central banks respond by tightening or easing policy. Therefore, rising inflation usually supports a currency, while falling inflation often weakens it. Monitoring CPI data and inflation expectations is essential in forex trading fundamental analysis.

Economic Growth and GDP

GDP growth indicates economic momentum. Strong and consistent growth attracts business investment and foreign capital inflows. As a result, currencies of expanding economies tend to appreciate.

Conversely, weak or contracting GDP discourages investment and reduces currency demand. Traders watch quarterly GDP releases, forecasts, and business surveys to track direction.

Employment and Labour Markets

Employment data reveals economic health at ground level. Low unemployment supports wage growth and consumption. Consequently, it contributes to inflation and influences central bank decisions.

High unemployment signals weak demand and slower growth. Therefore, labour data forms a critical pillar in professional fundamental analysis.

Trade Balance and Capital Flows

Trade balances measure export and import differences. Export-driven economies create consistent foreign demand for their currency. Meanwhile, persistent trade deficits require external financing, which can pressure currency value.

Capital flows add another layer. When foreign investors buy domestic assets, currency demand rises. When they exit, the currency falls. Monitoring these flows strengthens forex trading fundamental analysis accuracy.

Role of Central Banks in Forex Markets

Central banks sit at the core of currency valuation. They control liquidity, interest rates, and policy direction. Therefore, they shape global capital allocation daily.

Major institutions such as the Federal Reserve, European Central Bank, Bank of England, Bank of Japan, and Reserve Bank of Australia guide market expectations through statements, speeches, and policy actions.

Professional traders analyse tone, guidance shifts, and reaction functions to anticipate policy changes before they occur. Consequently, understanding central banks separates retail speculation from institutional-grade trading.

How Traders Apply Forex Trading Fundamental Analysis in Practice

Professional traders convert macro data into structured decision frameworks.

First, they compare relative economic strength across countries. Currency valuation is always comparative.

Next, they assess interest rate differentials and yield expectations. Higher future yields attract investment when risk conditions allow.

Then, they track economic surprise trends. Data beating forecasts strengthens currencies, while repeated misses weaken them.

After that, they incorporate fiscal policy, political stability, and global risk sentiment to refine conviction.

Finally, they align macro bias with technical execution tools. Therefore, forex trading fundamental analysis defines direction, while charts refine timing.

Serious traders do not guess. They follow macro structure, central bank logic, and economic data.

If you want to master forex trading fundamental analysis using institutional-grade frameworks, professional training accelerates your learning curve.

Build real macro conviction, not random speculation. Start developing professional-level forex analysis skills today.

Fundamental Analysis vs Technical Analysis

Fundamental analysis explains why markets move. Technical analysis helps decide when to enter or exit.

Professional traders combine both. Fundamentals create directional bias. Technicals manage execution and risk.

Relying only on charts can lead to trading noise. Using only fundamentals may cause early entries. However, combining both produces consistent, repeatable decision-making.

Common Mistakes in Forex Fundamental Analysis

Many traders misapply macro data.

One mistake is reacting to single data releases rather than sustained trends. Markets respond to trajectories, not isolated numbers.

Another mistake is ignoring expectations. Markets price forecasts ahead of reality.

Additionally, some traders fail to compare economies correctly. Currency pairs always reflect relative strength, not absolute conditions.

Professional forex trading fundamental analysis avoids these errors through structured data tracking and disciplined interpretation.

Building a Repeatable Fundamental Trading Framework

Consistency requires process.

Track core macro indicators for each economy. Update data regularly. Compare trends across countries.

Assess central bank direction and interest rate outlooks. Monitor inflation, GDP, employment, and trade metrics. Then, overlay global risk sentiment to adjust positioning.

Over time, this structured approach transforms complex information into clear directional conviction.

Why Professional Traders Focus on Macro Fundamentals

Institutional traders allocate billions based on macro expectations. Banks, hedge funds, and asset managers follow structured fundamental models to guide capital deployment.

They understand that price volatility creates opportunity, but economic reality defines sustained trends. Retail traders who adopt forex trading fundamental analysis gain access to the same strategic logic used by institutions.

In modern FX markets, information is everywhere. Interpretation is the real advantage.

Frequently Asked Questions

What is forex trading fundamental analysis in simple terms?

Forex trading fundamental analysis evaluates currencies by studying economic conditions, central bank policy, and macro data to understand why exchange rates move.

Is fundamental analysis better than technical analysis in forex?

Fundamental analysis provides long-term direction, while technical analysis refines timing. Professional traders combine both.

Which indicators matter most in forex trading fundamental analysis?

Interest rates, inflation, GDP growth, employment data, and trade balances are the core drivers of currency valuation.

How do central banks influence forex markets?

Central banks control interest rates and liquidity. Their policy decisions shape capital flows and currency strength.

Can beginners learn forex trading fundamental analysis?

Yes. Beginners who follow structured macro frameworks develop deeper market understanding and avoid emotional trading.